What is ADU and Why It’s the best investment you should consider?

History is the greatest teacher and with our most recent lesson in finance being The Great Recession of 2008, many homeowners are desperate to not only maintain their properties but find promising nest egg investments as well. According to Investopedia, due to inflation, compounding cost, and a lack of liquidity, a 401k is often not enough for retirement. In fact, many investment experts agree that in order to build a substantial retirement account, one must develop a diverse investment portfolio. While Roth IRA and 401k accounts do not guarantee stability and are often subject to stock market volatility, investment in property offers a far greater degree of financial control. After extensive research, we have found that one of the most effective property investments is the addition of an accessory dwelling unit, to an existing property. Read on to learn more.

What is ADU?

An accessory dwelling unit is essentially a secondary housing structure constructed on a single-family residential lot. In simpler terms, it is an additional small house that you can build on your property. In fact, despite its convoluted name, it is a small house. It even goes by other names; granny unit, granny flat, in-law suite, in-law cottage, mother-in-law apartment, or secondary dwelling unit, among others.

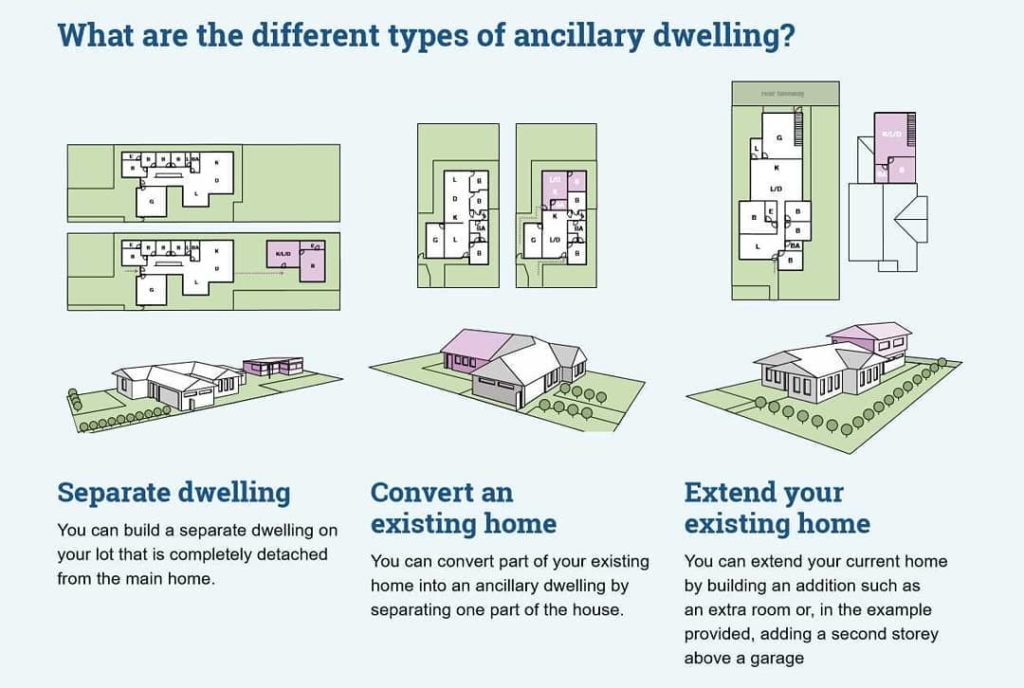

They come in a variety of shapes and sizes, but there are some common structural forms that can prove to be the most practical for homeowner consideration. These are as follows:

Interior ADU – Built in the primarily dwelling, these are typically converted basements, garages, or attics.

Attached ADU – These are structurally added that often “bump out” from the sides of homes or are built above garages.

Detached ADU – Built separately from the main housing structure, these are usually small cottages in backyards or additions to detached garages.

Some characteristics that distinguish ADUs from other housing units include; their small size relative to the average US house, their status as home “accessories,” and their often informal nature. Though regulated by zoning permits and other laws, permitted ones are less common than unpermitted ones due to a lack of streamline regulation in previous years.

Deciding to build and choosing its structure is entirely within the homeowner’s discretion. While construction ordinances initially made the process a little tricky, Governor Jerry Brown recently signed 3 ADU California bills back in 2016 in order to address the statewide housing crisis. These bills not only made the application process easier, but also made the state government regulation over parking, construction, and lot coverage more lax.

The recently passed bills are as follows:

Senate Bill 1069 – Reduced or in some cases, eliminated parking requirements and utility hook-up fees. It also sped up the approval process for second units attached to a primary residence.

Assembly Bill 2299 – Added an official definition to an ADU unit, describing it as: “… an attached or a detached residential dwelling unit which provides complete independent living facilities for one or more persons. It shall include permanent provisions for living, sleeping, eating, cooking, and sanitation on the same parcel as the single-family dwelling is situated.” (Sec.1.g.4) as well as set up official ordinances that henceforth serve as standards in areas with no laws and supreme in others.

Assembly Bill 2406 – Streamlined the process for homeowners converting an existing bedroom into an attached studio living unit.

These bills have proven to be instrumental in not only improving California housing conditions, but also aiding property owners in investing for the future. That being said, they are a lot to read through and may still leave you uncertain about legality.

Los Angeles Rules: Can I legally build an ADU on my property? (based on California law)

In short, most single-family homeowners can build ADUs in California. There are, however, some state laws and technicalities that are important to take into consideration:

1- A detached ADU must be at least 10 feet from the main residence and 5 feet from any property lines.

2- An attached ADU to a residence is limited to a maximum of 1,200 square feet in size or half the size of the existing residence. Detachable units cannot be larger than 1,200 square feet.

3- Trailers, RVs, and Campers are not ADUs, but can technically be used as such. Under current law, they are still classified as motor vehicles.

4- Building on a property constructed prior to 1978 will make the subject to rent control laws because once an it is built; a residence is no longer classified as a single-family home.

5- They can be listed on Airbnb –in some cities. LA structures, for example, are banned from such lists due to the city government’s need for longer rental periods.

6- Not all home additions are ADUs. Those looking to build residential offices or storage units can circumvent the necessary requirements to build by getting a standard addition permit.

City of Los Angeles ADU Ordinance 2020

With all of this in mind, it is important to point out that certain cities have opted to customize some of these and other state laws surrounding ADUs. For example, some Accessory Dwelling Unit Los Angeles addendums include height regulations not addressed by state laws. In accordance with LA terms, most units are restricted to a maximum height of 25 feet.

Furthermore, some cities impose other size restrictions. For examples, Glendale regulations limit sizes to 600 square feet. Other cities have yet to concretely define their restrictions. For example, while addendums impose height restrictions, the city has not settled on maximum square feet numbers. For more information on Los Angeles laws, please refer to the following CityLab Guidebook.

After considering all of the requirements, one might be tempted to ask about zoning and other permits. Will you need a permit? – the short answer is yes. The details are, once again, relative to your specific region. Going back to Los Angeles, residents of the city or surrounding areas are required make the following legal accommodations:

- You must present your development plans to your local department of building and safety. (it is recommended that you seek the help of a licensed architect).

- You will need to obtain a certificate of occupancy –this requires an investigation of the unit’s plumbing, electricity, and heating systems.

- You may need to acquire a parking permit. Consult the guidebook referenced earlier for more information on this.

What are the benefits of building an ADU?

Having read all of the California requirements and technical details, you may be discouraged. However, while construction seems like an arduous task, it is in reality simply a series of steps leading to a great list of benefits.

- More living space – They can assist you in supporting extended family members while allowing you to maintain your privacy.

- Ability to rent and generate a monthly income – Renting out ADUs can be a great benefit in terms of generating additional income to pay mortgage payments or for long term saving. According to a UC Berkeley study of ADUs, a sustainably design built from scratch can cost as little as $100k in initial fees and generate as much as $1,200 per month if rented out while keeping utility payments at a bare minimum.

- Quickly offset the cost of building – Most recover building costs within 3-5 years, making them ideal financial assets.

- Increase property value – A survey titled Understanding and Appraising Properties with Accessory Dwelling Units concluded that they generally contribute about 25-34% of a property’s assessed value and increase resale value by an average of 51%.

How much does it cost to convert garage to adu los angeles?

Building and other costs were mentioned briefly before, but how much would an California plan cost you? The answer is difficult to provide as the costs often vary based on the type and various building accommodations. Here are some rough averaged estimates based on tours and reports:

Detached ADU

- 616 sq. ft.

- 294 cost per sq. ft.

- Total = ~ $174k

Basement ADU

- 715.75 sq. ft.

- 231.5 cost per sq. ft.

- Total = ~$165k

Attached ADU

- 580 sq. ft.

- 232.5 cost per sq. ft.

- Total = ~$137k

Garage conversion ADU

- 549 sq. ft.

- 261 cost per sq. ft.

- Total = ~$140k

Above Garage ADU

- 1032.3 sq. ft.

- 190.3 cost per sq. ft.

- Total = ~$216k

What is the return on investment?

Given the complexity of planning, building, maintaining, and initial investment needed to build an ADU, one might consider if the ROI is worth the undertaking. In the previously mentioned examples, we have discussed how:

- A $100k investment can turn into a beautiful property with a rental payment of $1,200 per month.

Another thing to consider is that while the average costs of building ADUs are outlined above, California costs might be higher or lower depending on your specific region. For example, due to the high cost of living, Los Angeles construction might cost about the same ~$100k (or less) whereas rent can be increased to around $1,800 – $2,000 per month –at least according to one homeowner’s experience.

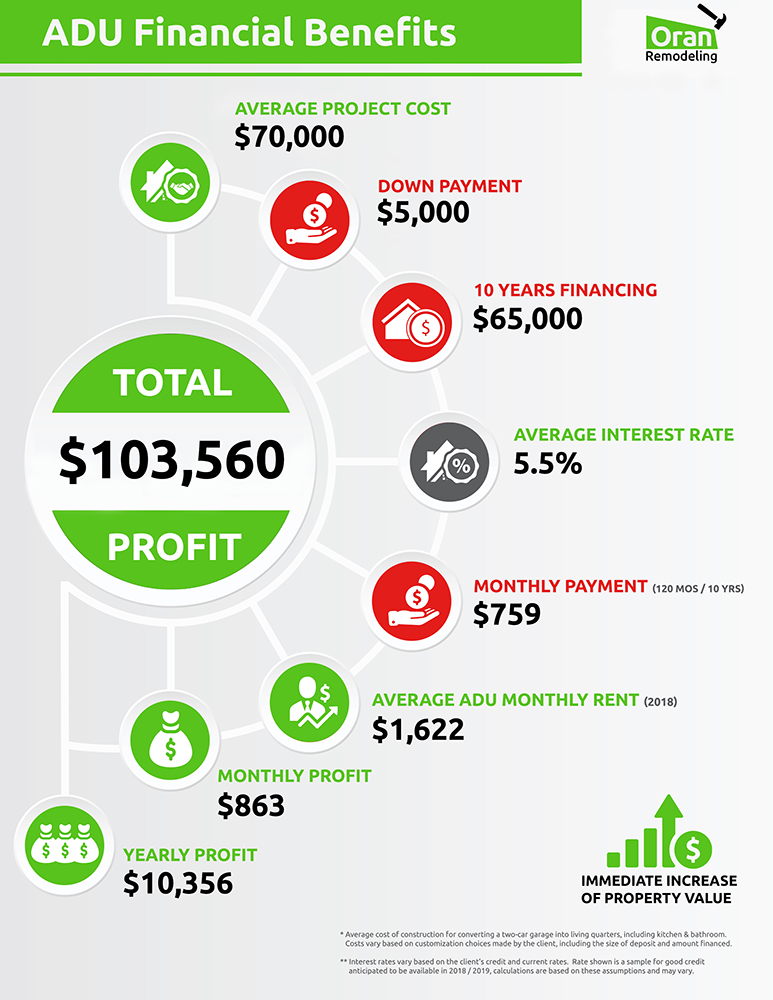

Given these figures, we estimate that:

- An ADU can cover construction costs in roughly: 3-5 years.

- It can generate up to: $21,000 of additional income annually.

With the mean mortgage costs of LA being roughly $3,068 per month:

- It can potentially cover up to 60% of your mortgage payment.

Here is a rough breakdown of your ADU potential return:

- Investment Cost: ~$70,000

- Monthly Rent Potential: ~$1,700

- Monthly Profit: ~$863

- Annual Return: ~$11,000

- Return After 10 Years: ~$103,000

- And an Immediate Increase In Property Value

As indicated, an ADU can provide you with a tremendous amount of discretionary income for long-term investing or spending as you please. In just a few short years, your ROI can build up to a substantial sum, facilitating a long and stress-free retirement.

Summary:

If The Great Recession of 2008 has taught us anything, it is that the future is uncertain and investment portfolios do not guarantee future financial stability. Property, however, is not an abstract figure on a chart; it is a tangible asset with ever-present market viability and rapidly increasing demand. ADU construction, though complex and sometimes costly, can prove to be an excellent long-term investment for the average American citizen. Within 3-5 years, it can ensure financial stability for you and your family by providing you with a steady stream of additional income for bill payments, long-term investing, saving, and spending at your discretion.